|

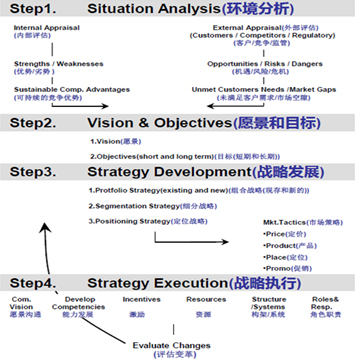

Strategy Planning Process Introduction /Finance Management

What is strategy, how can we apply business models to market? |

| |

|

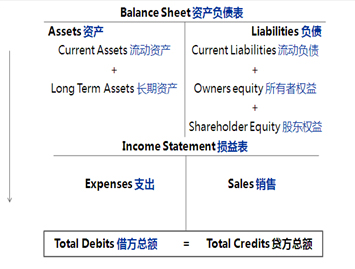

Balance sheet and income statement

As a business owner it’s important to understand how to read your financial statements, interpret what they are telling you and know how to use them as a management tool. Too often business manager miss out on important information that can help guide their decision making. Financial statements will always tell you “where” there is a business issue – never “why”! However understanding where the root of the issue lies is an important first step toward good business management. As businesses grow “gut feel” and “intuition” are no longer enough. Business managers need to understand their business financial statements.

|

| |

|

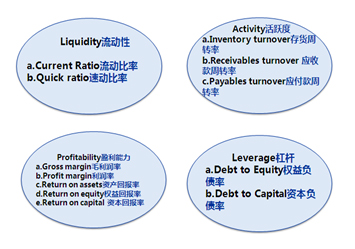

Ratio Analysis

Business managers today need to know key ratios that can easily be calculated from their financial statements. This session explores simple ratios like gross profit and cost of goods sold and then goes beyond that to uncover the 13 common ratios that financial people look at to determine the health of a business. In this session we’ll also discuss what margins to watch and what danger signs to keep an eye out for that can signal your business will be in trouble if remedial steps aren’t taken.

|

| |

|

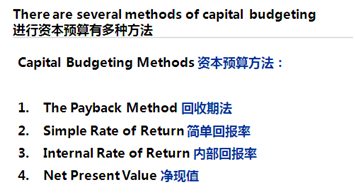

Capital budgeting

Capital budgeting decisions are big ones – get them right and watch your business grow – get them wrong and they can spell the end of your business. How to evaluate the return on investment of Capital investments is an important skill every business manager needs to understand. What is the time value of money and why is it important; why should sunk costs be ignored in these decisions; and how to make a “go or no go” capital investment decision are just some of the topics covered in this session.

|

| |

|

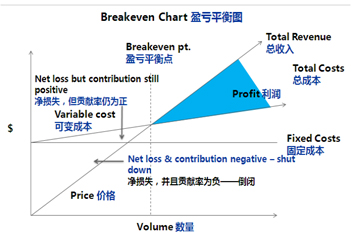

Contribution rates

It’s important as a retailer to understand where your profit is coming from. Discounting product needs to be done strategically to drive store volume. Many managers discount randomly destroying store margins and killing profit. In this session participants will learn how to determine the % increase in sales a discount must generate in order for it to break even – often the calculations are mind opening! This session is the summary of risk analysis.

|

| |

|

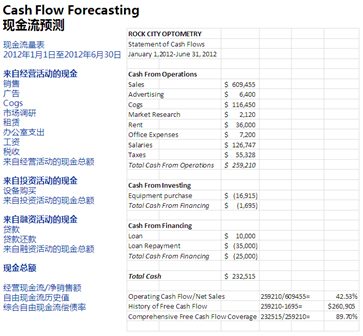

Cash Flow management

Growing businesses often go out of business due to lack of cash – not lack of profit. Knowing one’s cash flow and understanding when there will be a cash short fall can help with business planning. Business managers who develop cash flow statements and use them as a financing tool greatly improve their relationship with their financial institution and their chances of surviving in the future. Bankers are often very willing to work with businesses who understand when and why there will be a cash shortfall and prepare for the event in advance. Hoping to have enough cash on hand to meet future financial obligations is a fools’ game!

|

沪公网安备 31011502013770号

沪公网安备 31011502013770号